Student Accounts1098T Form

What is a 1098T form?

Colleges and universities are required to report information on enrolled students to the Internal Revenue Service. The information is reported on a 1098-T form. Payment of qualifying tuition related expenses (QTRE) - i.e. largely the tuition portion of the student bill, and does not include expenses such as room & board, insurance or health fees as qualifying expenses - can have income tax implications for U.S. residents. As advised in your December e-bill, you should consult your income tax advisor if you have questions on whether it is better for you to make payment for the spring 2025 term in calendar year 2024 or 2025. 1098T forms will be available online in late January 2025.

Important to note:

Under federal law, we report in Box 1 the amount of payments received for QTRE paid during the calendar (tax) year. Categories that are included in box 1 as payments include: checks, lockbox payments, wires, online payments, loans, grants, scholarships and outside scholarships.

What do I use this form for?

Depending on your income (or your family's income, if you are a dependent), whether you were considered full or half-time enrolled, and the amount of your qualified educational expenses for the year, you may be eligible for a federal education tax credit. (You can find detailed information about claiming education tax credits in IRS Publication 970, page 9.)

The dollar amounts reported on your Form 1098-T may assist you in completing IRS Form 8863, the form used for calculating the education tax credits that a taxpayer may claim as part of your tax return.

Hobart and William Smith Colleges is unable to provide you with individual tax advice, but should you have questions, you should seek the counsel of an informed tax preparer or adviser, or the IRS at 800-829-1040.

How do I obtain my 1098T form?

The 2024 1098T forms were mailed out in late January 2025 to the student permanent address on file. We have now partnered with Nelnet and TAB Services to also have these forms available for download right within the student’s Nelnet account.

For tax filers: If your student has not yet set you up to be an authorized party in Nelnet for billing purposes, this is an additional reason to have this access. Instructions for students to set up authorized parties, paying particular attention to steps 7-10, can be found here.

Authorized parties can then access/manage the account and 1098T forms at any time by logging into https://online.campuscommerce.com after account set up is complete.

Forms issued prior to 2024 can be retrieved from Heartland ECSI via Heartland ECSI website. ECSI representatives can be reached at cservice@ecsi.net or from 7:30 AM - 8:00 PM EST, Monday to Friday at 866.428.1098.

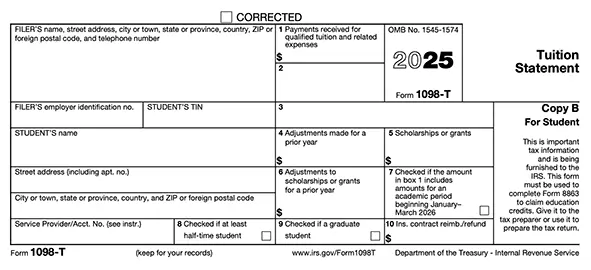

What will the form look like?

Below is a blank sample of Form 1098-T, for your general reference.